Certainly! Here’s the article:

Market Sentiment Shifts as Breadth Indicator Points to Potential Opportunities

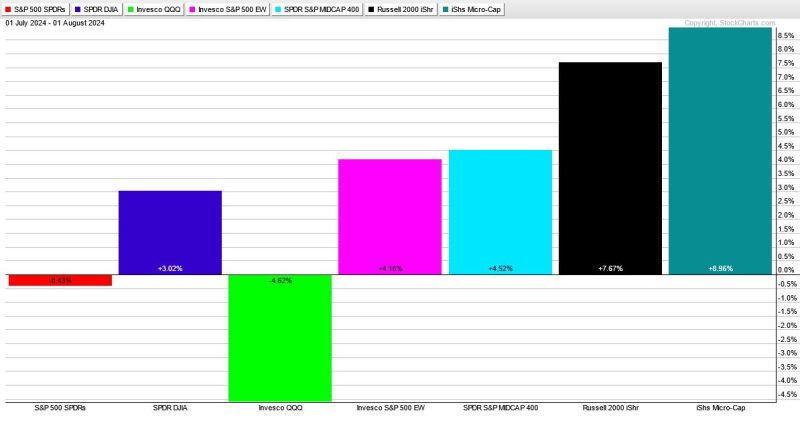

In the world of finance and investing, a breadth indicator is a critical tool used by analysts and traders to gauge the overall health and direction of the market. Recently, a significant breadth indicator has caught the attention of market observers, hinting at more downside potential but also presenting a unique opportunity for those willing to take a contrarian stance.

The breadth indicator in question focuses on the number of stocks participating in a market rally or decline. Its premise is simple yet powerful – a healthy market rally is typically supported by a broad participation of stocks moving higher, while a weak market rally often sees only a small group of stocks leading the charge. Understanding this dynamic is essential for investors looking to make informed decisions in a volatile market environment.

With the current state of the market showing signs of strain and uncertainty, the breadth indicator has begun to flash warning signals. The lack of broad participation in recent market gains suggests that the current rally may not be sustainable in the long run. This development has prompted some investors to adopt a cautious approach and reassess their investment strategies to navigate potential downside risks.

However, amid the prevailing market pessimism, there lies a potential opportunity for savvy investors with a contrarian mindset. By recognizing that the breadth indicator points to more downside potential, these investors can position themselves to take advantage of undervalued assets and opportunities that may emerge during market corrections. Contrarian investing involves going against the prevailing market sentiment and finding value in areas that others may overlook.

While the prospect of further market declines may unsettle some investors, it is essential to remember that periods of volatility often create opportunities for those who are prepared to act decisively. By staying informed, maintaining a disciplined approach, and leveraging tools such as breadth indicators to assess market conditions, investors can position themselves to capitalize on potential opportunities that arise amidst market turbulence.

In conclusion, the current market environment presents a unique set of challenges and opportunities for investors. By paying close attention to breadth indicators and understanding their implications, investors can gain valuable insights into market dynamics and potential trends. While the breadth indicator may point to more downside in the short term, it also highlights the potential for contrarian investors to seize opportunities that may arise as market conditions evolve. As always, thorough research, sound judgement, and a long-term perspective are essential for navigating the complexities of the financial markets and achieving investment success.