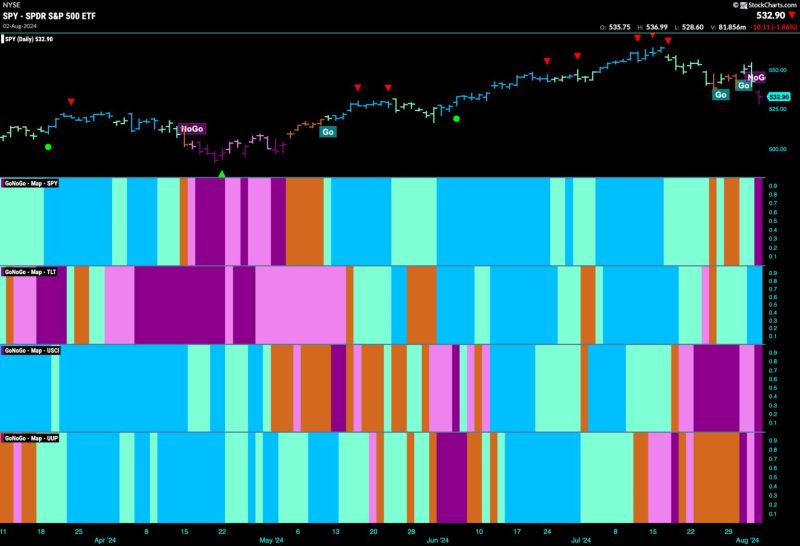

Stocks Get Defensive as Market Index Enters ‘No Go’ Zone

The recent market fluctuations have led to increased caution among investors, as the market index enters what some analysts are calling a ‘No Go’ zone. This shift in market sentiment has caused many investors to adopt a more defensive stance in their investment strategy.

One of the primary reasons for this defensive posture is the uncertainty surrounding global trade tensions, particularly between the United States and China. The ongoing trade dispute has created a cloud of uncertainty over global economic growth, leading investors to seek out safer assets in order to protect their portfolios from potential losses.

To mitigate the risks associated with the current market environment, investors are turning to defensive stocks. These types of stocks are known for their stability and ability to weather market downturns better than more volatile growth stocks. Defensive sectors such as utilities, healthcare, and consumer staples are seeing increased interest from investors seeking to protect their investments.

In addition to defensive stocks, investors are also turning to dividend-paying stocks as a way to generate income in a low-interest-rate environment. Dividend stocks provide a steady stream of income through regular dividend payments, making them an attractive option for investors looking for stability and income generation.

Another defensive strategy being employed by investors is diversification. By spreading their investments across a variety of asset classes, sectors, and geographies, investors can reduce their overall risk exposure and protect their portfolios from the impact of any single market event or economic downturn.

While the current market conditions may be challenging, they also present opportunities for savvy investors to position their portfolios for long-term success. By adopting a defensive investment strategy that focuses on stability, income generation, and diversification, investors can navigate the turbulent market waters and emerge on the other side with their portfolios intact.