In the world of finance, the Nifty index is a key player, often indicating the overall sentiment of the market. As we move forward into the upcoming week, the Nifty is displaying a cautious tone as a defensive setup starts to take shape. By understanding key levels and market dynamics, investors can better navigate through this uncertain period.

The Nifty index has been exhibiting a tentative demeanor in recent days, reflecting the underlying uncertainty that exists in the markets. This sentiment is further reinforced by the emergence of a defensive setup, where investors are seeking refuge in defensive stocks that are relatively less impacted by market fluctuations. This shift in sentiment suggests a wariness among market participants, possibly in response to external economic factors or global events that could potentially impact the market.

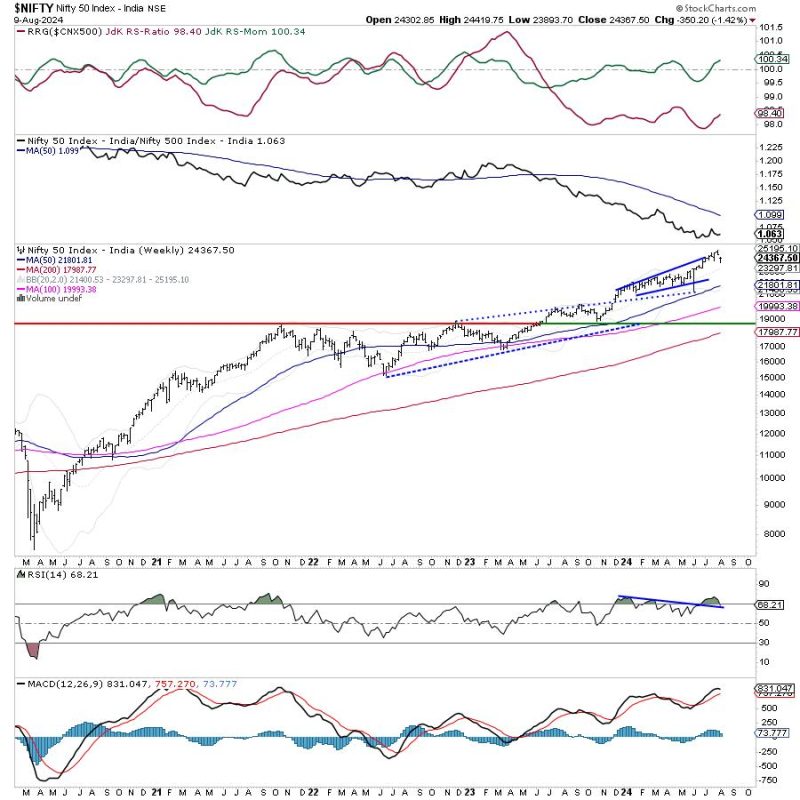

In order to effectively navigate through this evolving landscape, investors need to be aware of certain key levels that could act as crucial support or resistance points for the Nifty index. By closely monitoring these levels, investors can better gauge the strength of the market’s current trend and make more informed decisions regarding their investment strategies.

One level of importance is the immediate support level for the Nifty index, which could provide a floor for potential downside movements. By identifying this level and closely observing how the market reacts to it, investors can better assess the underlying strength of the current market trend and determine whether further downside is likely.

On the other hand, it is also essential to pay attention to key resistance levels that could potentially hinder the Nifty’s upward momentum. By recognizing these levels and monitoring the market’s behavior around them, investors can gain valuable insights into potential obstacles that could impact the Nifty’s ability to rally further.

In addition to these key levels, investors should also keep a close eye on market indicators and technical analysis, which can provide valuable insights into market sentiment and potential future movements. By utilizing these tools in conjunction with an understanding of key levels, investors can enhance their ability to make sound investment decisions in the face of uncertainty.

As we head into the upcoming week, it is crucial for investors in the Indian market to remain vigilant and continuously reassess their investment strategies in response to evolving market dynamics. By staying informed, being aware of key levels, and utilizing market indicators effectively, investors can navigate through the current tentative environment with greater confidence and agility.