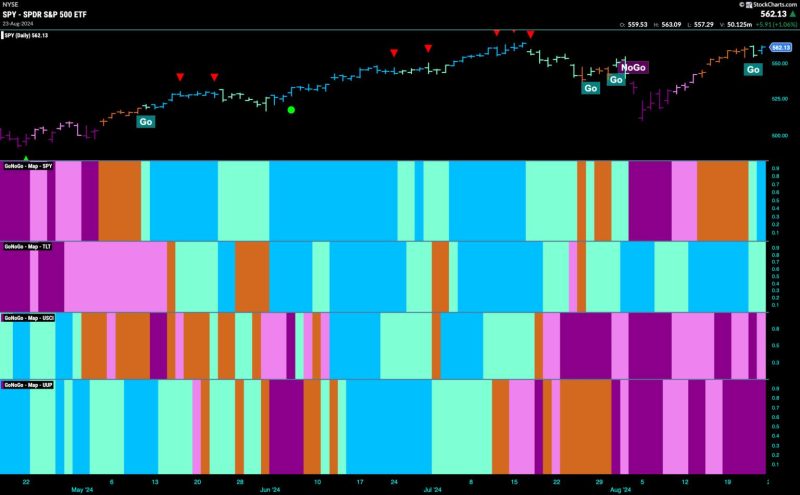

Equities Continue to Surge Amid Healthy Rotation

Following several weeks of surging stock prices, equities globally continue their upward trajectory as markets navigate through healthy rotations in various sectors. Investors have been closely monitoring the ever-evolving landscape, adjusting their portfolios to capitalize on emerging opportunities and potential risks.

One of the primary drivers behind the continued surge in equities has been the strong corporate earnings reports from major companies across different industries. As the global economy gradually recovers from the impacts of the pandemic, businesses have adapted their strategies, resulting in robust financial performance and optimistic outlooks. This positive sentiment has bolstered investor confidence and fueled the upward momentum in equities.

Furthermore, the ongoing rotation within the stock market has been a key theme in recent market developments. Investors are reallocating their funds from sectors that have outperformed in the past to those that are poised for growth in the future. This rotation reflects a healthy adjustment in market dynamics, ensuring that capital flows into areas with the most potential for long-term returns.

Technology stocks, which have been among the top performers in recent years, have experienced some volatility as investors seek to diversify their portfolios and capitalize on opportunities in other sectors. Cyclical stocks, particularly those in industries such as energy, financials, and industrials, have seen increased interest as the global economy shows signs of recovery. This shift in allocation highlights the importance of maintaining a well-diversified portfolio to mitigate risks and capture opportunities across different sectors.

Geopolitical events and macroeconomic factors have also influenced market sentiment and contributed to the overall surge in equities. Ongoing trade negotiations, policy decisions by central banks, and geopolitical tensions have added an element of uncertainty to the market environment. However, investors have shown resilience and adaptability in navigating these challenges, leveraging market trends and data-driven insights to make informed investment decisions.

As equities continue to surge amid healthy rotation, it is essential for investors to remain vigilant and stay informed about developments in the global economy and financial markets. Diversification, risk management, and a long-term investment outlook are key principles to navigate the dynamic nature of the stock market effectively. By closely monitoring market trends, evaluating investment opportunities, and maintaining a disciplined approach, investors can position themselves to capitalize on the ongoing surge in equities and achieve their financial goals.