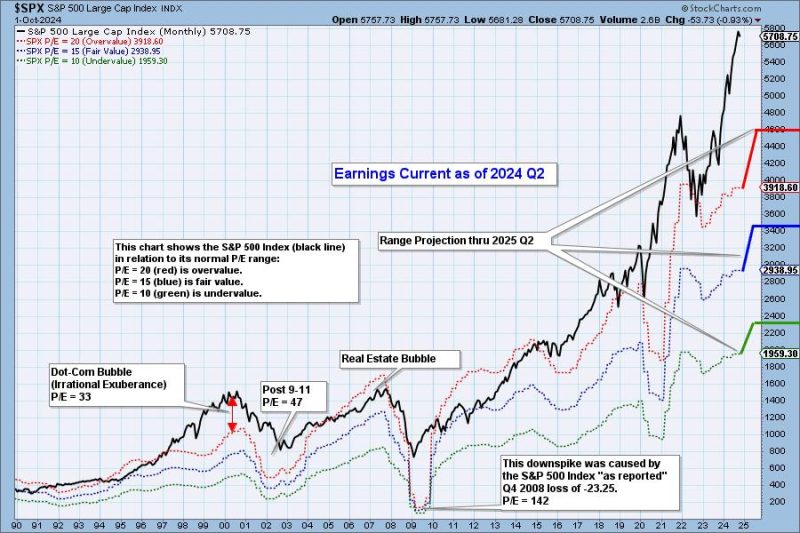

According to a recent analysis of market trends and financial data for the second quarter of 2024, it has been observed that the current market remains very overvalued. This assessment raises concerns about the potential risks and vulnerabilities that investors may face in such an environment.

One key indicator of the market being overvalued is the price-to-earnings (P/E) ratio, which measures the relationship between a company’s stock price and its earnings per share. A high P/E ratio suggests that investors are paying a premium for the company’s earnings, indicating that the stock may be overvalued. In the second quarter of 2024, many companies reported strong earnings, but the market’s response to these earnings was disproportionately bullish, leading to inflated stock prices and further increasing the overall P/E ratio.

Additionally, the price-to-sales (P/S) ratio is another metric that can help determine whether a market is overvalued. This ratio compares a company’s market capitalization to its annual sales revenue, providing insights into how much investors are willing to pay for each dollar of sales generated by the company. A high P/S ratio can indicate that a stock is overvalued, as investors are valuing the company based on its revenue potential rather than its actual profitability. During the second quarter of 2024, the P/S ratio for many companies reached alarmingly high levels, signaling a disconnect between stock prices and actual sales performance.

Moreover, market sentiment and investor behavior play a crucial role in determining whether the market is overvalued. Fear of missing out (FOMO) and herd mentality can drive stock prices to unsustainable levels, leading to speculative bubbles that eventually burst. In an overvalued market, irrational exuberance and excessive optimism can blind investors to the underlying risks and vulnerabilities present in the market. As a result, investors may become complacent and fail to adequately assess the true value of their investments, leaving them exposed to significant losses when the market corrects.

In conclusion, the analysis of the second quarter of 2024 earnings indicates that the market remains very overvalued, with high P/E and P/S ratios, driven by investor sentiment and behavior. Investors should exercise caution and conduct thorough research before making investment decisions in such an environment to mitigate potential risks and protect their portfolios. Staying informed, diversifying investments, and focusing on long-term growth rather than short-term gains are essential strategies for navigating an overvalued market successfully.