In the fast-paced world of trading, investors and traders constantly analyze market trends to make informed decisions. The upcoming week in the Nifty index is expected to remain in a relatively narrow range, with potential for trending moves if certain key levels are breached.

Technical analysis plays a crucial role in predicting market movements, and traders often rely on key support and resistance levels to identify potential entry and exit points. In the case of the Nifty index, the range-bound trading is expected to persist, offering both short-term trading opportunities within the range and potential breakout opportunities if key levels are breached.

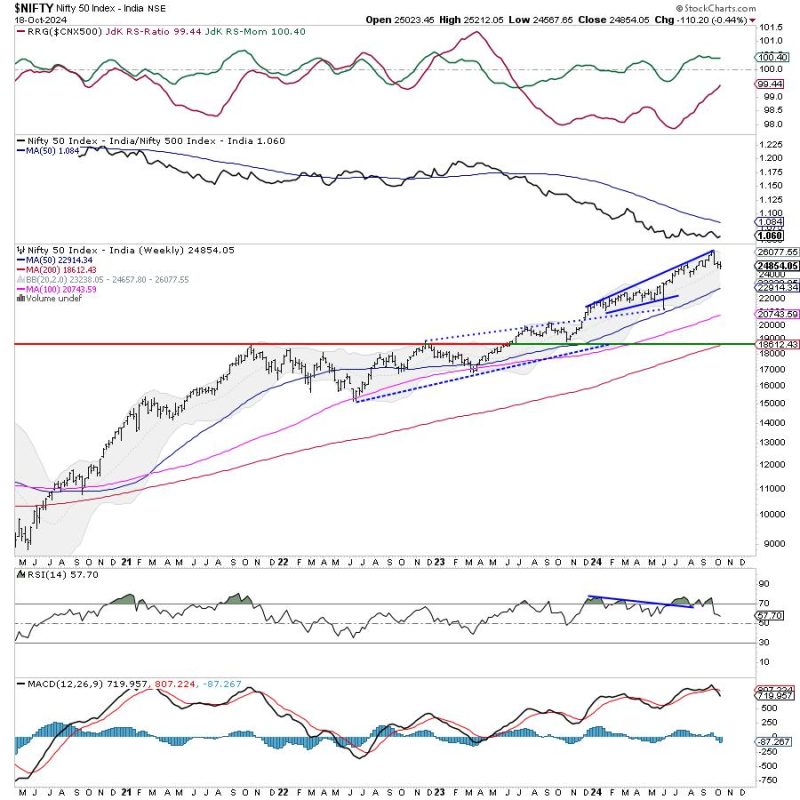

As traders navigate the market dynamics during the upcoming week, it is important to pay close attention to the technical indicators that can provide valuable insights. Moving averages, relative strength index (RSI), and Fibonacci retracement levels are commonly used tools to gauge market sentiment and potential price movements.

Furthermore, the upcoming week in the Nifty index could see increased volatility if external factors such as global market trends, economic data releases, or geopolitical events impact investor sentiment. Being aware of these external factors can help traders anticipate market movements and adjust their trading strategies accordingly.

While the Nifty index may remain range-bound in the near term, traders should remain vigilant and monitor the price action closely for potential breakout opportunities. The ability to adapt to changing market conditions and act decisively based on technical analysis and market dynamics is key to successful trading in the stock market.

In conclusion, the upcoming week in the Nifty index is expected to be characterized by a narrow trading range, with the potential for trending moves if key support and resistance levels are breached. Traders should leverage technical analysis tools, remain informed about external factors influencing the market, and stay flexible in their trading strategies to capitalize on opportunities that may arise. By staying disciplined and proactive in their approach, traders can navigate the market dynamics effectively and make informed decisions to achieve their trading objectives.