In the dynamic world of finance, particularly in the realm of stock markets, there are key technical indicators that traders and investors keenly observe to make informed decisions. One of the pivotal benchmarks frequently referenced when analyzing the Indian stock market is the Nifty index. The Nifty index, comprising of the top 50 companies listed on the National Stock Exchange of India, serves as a barometer for the broader market sentiment.

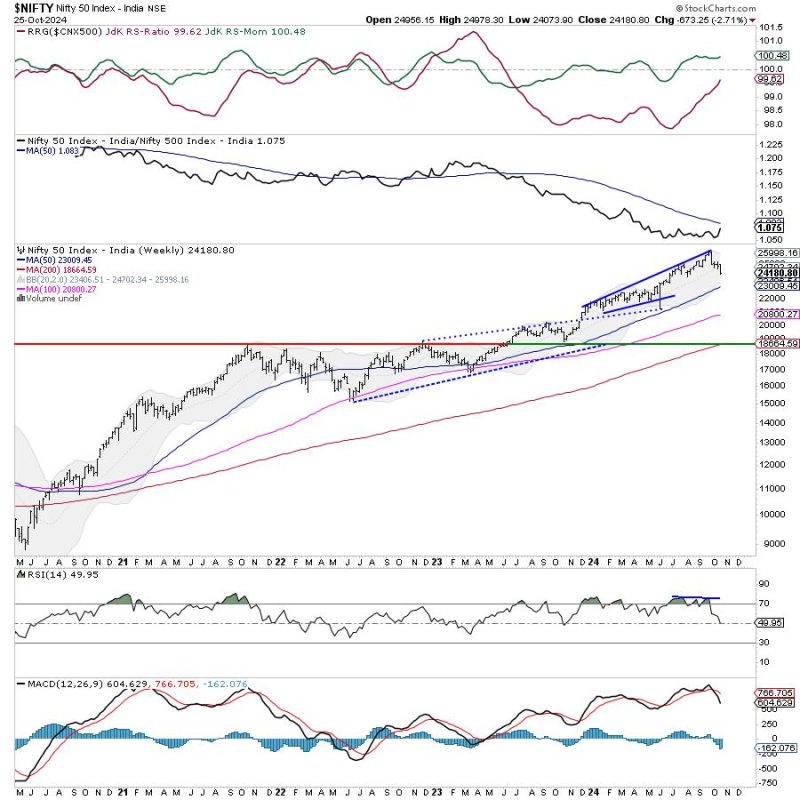

Recent trends in the Nifty index have portrayed a shift in market dynamics, pointing towards a potential change in investor sentiment. The violation of key support levels by the Nifty has raised concerns among market participants, with implications for near-term market movements.

Technical analysis plays a crucial role in understanding market trends, and the breach of support levels is often seen as a bearish signal. Traders closely monitor these levels as they signify a potential reversal in market direction. As the Nifty breaches support levels, it exerts downward pressure on the index, indicating a shift towards a bearish trend.

The violation of key support levels in the Nifty index has also influenced resistance levels, pushing them lower. Resistance levels denote a price point at which a stock or index finds it challenging to surpass, often acting as a barrier to further upside movement. The downward adjustment of resistance levels following the breach of support indicates a diminished bullish momentum in the market.

Market participants are now faced with the task of reassessing their investment strategies in light of the changing market dynamics. Factors such as global economic conditions, domestic policy decisions, and corporate earnings will play a pivotal role in shaping market sentiment in the coming days.

It is essential for investors to adapt to evolving market scenarios by staying informed and agile in their decision-making processes. Analyzing technical indicators, such as support and resistance levels in the Nifty index, can provide valuable insights into market trends and potential price movements.

As the Nifty continues to navigate through challenging terrains, traders and investors must exercise caution and employ a disciplined approach to navigate the uncertainties in the market. By staying attuned to market signals and conducting thorough research, market participants can position themselves strategically to capitalize on emerging opportunities and mitigate risks in an ever-changing financial landscape.