The article you provided analyzes short-term bearish signals in the market as it prepares for a week filled with significant news events. Let’s delve into the key points and provide a thorough overview of the subject matter.

The article mentions the upcoming week being loaded with crucial economic data releases, including earnings reports, Federal Reserve statements, and employment figures. These data points will potentially have a substantial impact on market sentiment and direction.

Moreover, the article highlights the recent concerns over inflation and rising interest rates, further adding to the current uncertainty in the market. Investors are carefully monitoring these factors and adjusting their strategies accordingly to navigate the volatile landscape.

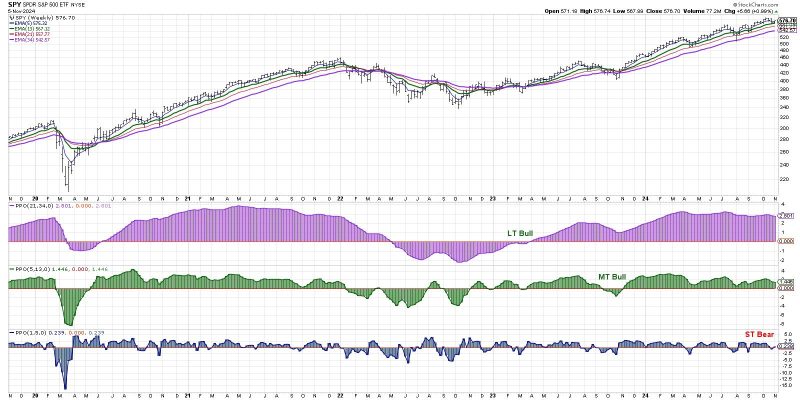

The author also points out technical indicators that signal a short-term bearish trend, raising caution among market participants. Traders are advised to remain vigilant and responsive to market movements to safeguard their investments during this anticipated period of increased volatility.

Furthermore, the article discusses the potential impact of geopolitical tensions on market dynamics. The ongoing geopolitical events and uncertainties could exacerbate market fluctuations and influence investor behavior in the short term.

In conclusion, the article paints a cautious outlook for the market in the short term, emphasizing the importance of staying informed, responsive, and flexible in the face of upcoming news-heavy events. By being attuned to market signals, trends, and external factors, investors can better position themselves to weather potential market downturns and capitalize on opportunities that may arise.