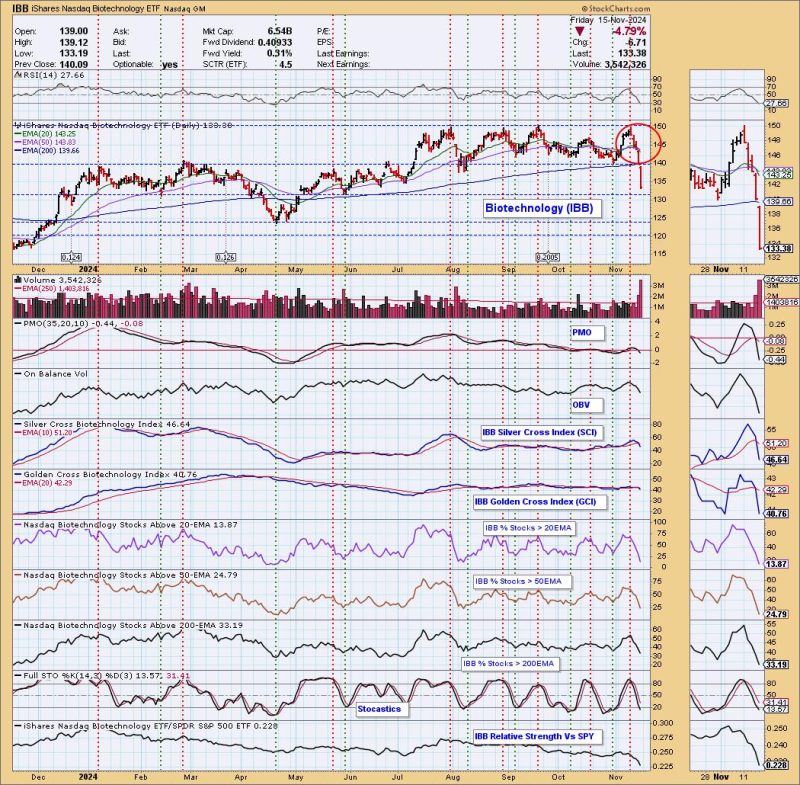

Biotechs Fall Apart with Dark Cross Neutral Signal

In the ever-evolving world of biotechnology, trends and signals can often hint at the future of the industry. One such signal that has recently emerged is the Dark Cross Neutral Signal, which has sent shockwaves through the biotech sector. This signal, often viewed as a bearish indicator, has been causing a stir among investors and analysts alike, leading to a significant downturn in many biotech stocks.

The Dark Cross Neutral Signal, characterized by the 50-day moving average crossing below the 200-day moving average, is a technical pattern that is closely watched by traders and investors. This signal is often seen as a warning sign of potential weakness in a stock or sector, indicating a possible reversal of the current uptrend.

Biotechnology companies, which are known for their volatility and sensitivity to market conditions, have been particularly hard hit by the Dark Cross Neutral Signal. Many biotech stocks have seen sharp declines in recent weeks, as investors react to the bearish implications of this signal.

One of the key factors driving the downturn in biotechs is the broader market environment. Uncertainty surrounding macroeconomic factors, such as interest rates and inflation, has weighed heavily on investor sentiment, leading to a flight to safety in more stable sectors. This flight to safety has left biotechs vulnerable to the negative effects of the Dark Cross Neutral Signal.

Furthermore, ongoing regulatory challenges and pricing pressures in the healthcare sector have added to the woes of biotech companies. The increasing scrutiny of drug pricing practices and regulatory hurdles have sapped confidence in the sector, further exacerbating the impact of the Dark Cross Neutral Signal.

Despite the current challenges facing biotechs, some analysts remain cautiously optimistic about the long-term prospects of the sector. Biotechnology companies are renowned for their innovation and ability to develop breakthrough treatments, which could drive future growth and value creation.

In conclusion, the Dark Cross Neutral Signal has cast a shadow over the biotech sector in recent weeks, leading to significant declines in many biotech stocks. While the current environment is challenging, the underlying strengths of biotech companies and their potential for innovation may offer a glimmer of hope for investors looking beyond the short-term turbulence. As always, it is crucial for investors to conduct thorough research and due diligence before making any investment decisions in the biotech sector.