Investing in Chromium Stocks: A Lucrative Opportunity

Understanding Chromium and Its Importance in Industrial Applications

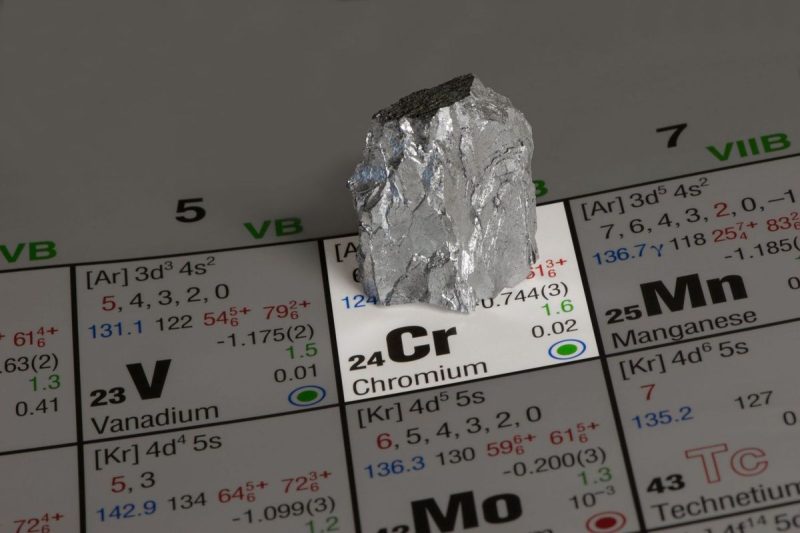

Chromium, a transition metal known for its high corrosion resistance and hardness, plays a crucial role in various industries worldwide. With a wide range of applications, including stainless steel production, aerospace components, electroplating, and more, chromium is a vital element in modern manufacturing processes.

As global demand for stainless steel continues to rise, driven by infrastructure development and technological advancements, the market for chromium remains robust. This sustained demand presents an attractive opportunity for investors looking to capitalize on the chromium industry’s growth potential.

Factors Influencing Chromium Prices and Market Trends

Several factors influence the pricing and market trends of chromium stocks, making it essential for investors to stay informed and vigilant. One of the primary determinants is the supply and demand dynamics within the chromium market. Any disruptions in the global supply chain, such as geopolitical tensions, trade policies, or environmental regulations, can impact chromium prices significantly.

Moreover, the overall economic outlook and industrial activity also play a crucial role in shaping the demand for chromium. As key industries like automotive, construction, and consumer electronics continue to expand, the need for chromium-based products is expected to remain strong, driving market growth and stock performance.

Analyzing Key Players and Investment Opportunities in the Chromium Sector

When considering investing in chromium stocks, it is essential to analyze key players in the industry and their growth prospects. Companies engaged in chromium mining, processing, and distribution, such as Glencore, Anglo American, and Samancor Chrome, offer exposure to the chromium market and provide investment opportunities for interested stakeholders.

Additionally, investors can explore opportunities in exchange-traded funds (ETFs) focused on metals and mining sectors, offering diversified exposure to chromium and other industrial metals. These ETFs provide a convenient means of gaining exposure to the broader industrial metals market while mitigating company-specific risks.

Understanding the Risks and Benefits of Investing in Chromium Stocks

While investing in chromium stocks can offer significant growth potential and portfolio diversification benefits, it is crucial to be aware of the associated risks. Like any commodity-linked investment, chromium stocks are subject to price volatility, influenced by factors such as market speculation, supply disruptions, and macroeconomic conditions.

Furthermore, regulatory changes, environmental concerns, and industry-specific challenges can impact the performance of chromium stocks, necessitating a thorough risk assessment before making investment decisions. By conducting thorough research, monitoring market trends, and diversifying investment portfolios, investors can effectively manage risks and capitalize on the growth opportunities presented by the chromium industry.

Conclusion

In conclusion, investing in chromium stocks presents a compelling opportunity for investors seeking exposure to the industrial metals sector’s growth potential. With the increasing demand for stainless steel and chromium-based products across various industries, the chromium market remains a key driver of global economic growth and industrial development.

By understanding the factors influencing chromium prices, analyzing key players in the industry, and assessing the risks and benefits of investing in chromium stocks, investors can make informed decisions and position themselves strategically in the evolving chromium market landscape. Thus, for investors looking to diversify their portfolios and capitalize on the ongoing industrial expansion, chromium stocks offer a promising avenue for long-term growth and profitability.