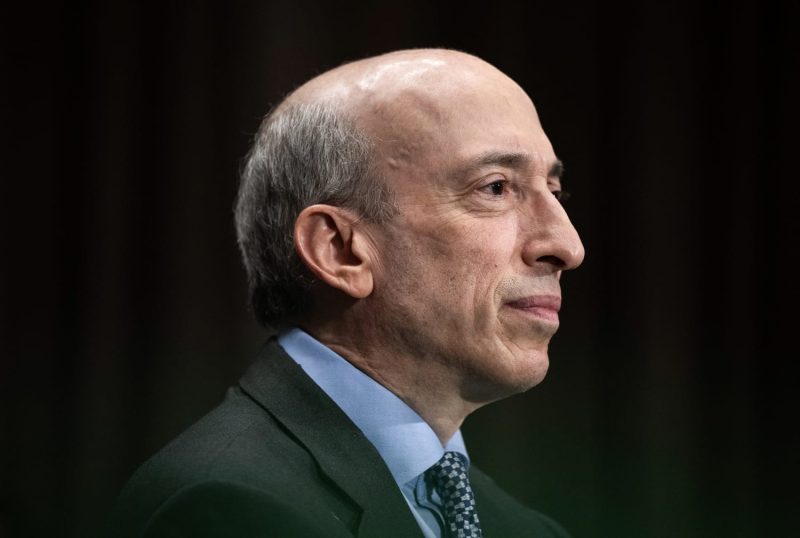

In a surprising turn of events, SEC Chair Gary Gensler recently announced his decision to step down from his position on January 20, setting the stage for President Trump to appoint a replacement to lead the Securities and Exchange Commission. Gensler’s departure comes after a tumultuous tenure marked by significant regulatory reforms and high-profile clashes with the industry.

During his time at the helm of the SEC, Gensler made a name for himself as a fierce advocate for investor protection and market transparency. He spearheaded several key initiatives aimed at tightening regulations on Wall Street and holding corporations accountable for their actions. Gensler’s efforts to enhance disclosure requirements, crack down on insider trading, and boost oversight of cryptocurrency markets earned him both praise and criticism from various quarters.

One of Gensler’s most contentious moves was his push for greater scrutiny of special purpose acquisition companies (SPACs), which have gained popularity in recent years as a way for companies to go public through mergers with blank-check entities. Gensler raised concerns about the lack of transparency and investor protections in the SPAC market, leading to new regulatory proposals that sought to address these issues. His tough stance on SPACs drew mixed reactions from industry insiders, with some applauding his efforts to safeguard investors while others criticized him for stifling innovation and potential business opportunities.

In addition to his focus on SPACs, Gensler also made headlines for his proactive approach to regulating digital assets and cryptocurrencies. He prioritized bringing clarity to the regulatory landscape surrounding these emerging assets, leading to the proposal of new rules and guidelines to govern their trading and issuance. Gensler’s efforts to rein in the crypto industry were met with resistance from some enthusiasts and industry players who viewed his actions as overreaching and stifling innovation.

As Gensler prepares to step down from his post, the financial industry is abuzz with speculation about who will succeed him as SEC Chair. With President Trump expected to nominate a replacement, there is anticipation about the potential direction the regulatory agency will take under new leadership. The chosen candidate will inherit a complex regulatory environment shaped by Gensler’s initiatives and will face the challenge of balancing investor protection with fostering market innovation and growth.

In conclusion, Gary Gensler’s impending departure as SEC Chair marks the end of an eventful chapter in the regulatory landscape of the financial industry. His tenure was defined by a proactive approach to enforcement and a commitment to strengthening investor protections, even at the cost of ruffling feathers within the industry. As the SEC braces for a new leader to take the reins, the legacy of Gensler’s regulatory reforms will continue to shape the future direction of financial markets and investor confidence.