The Hindenburg Omen, a technical indicator that analyzes market breadth, has recently sparked concerns among investors after flashing an initial sell signal. Defined by a convergence of market factors signaling potential trouble ahead, the Hindenburg Omen has historically been associated with increased market volatility and impending downturns. This development has captured the attention of market participants, prompting discussions about the potential implications for future market performance.

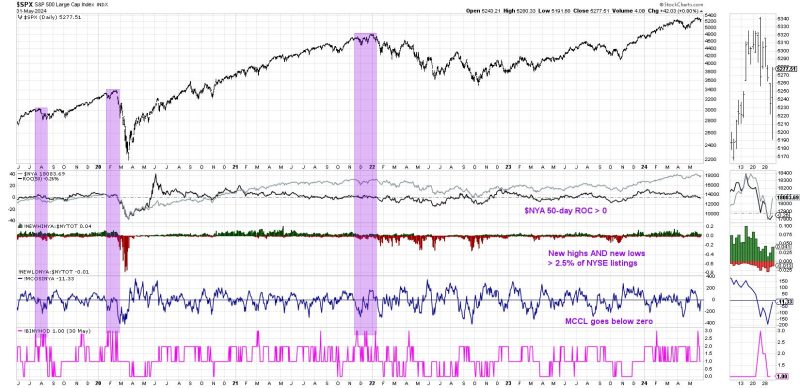

The Hindenburg Omen derives its name from the Hindenburg airship disaster in 1937, symbolizing the potential for a market crash or severe downturn. It is based on specific criteria that must be met simultaneously to trigger the signal. These criteria include a rising number of stocks reaching new highs and new lows, a significant increase in market volatility, and a market index that is both rising and falling at the same time. When these conditions align, it suggests underlying instability in the market that could lead to a correction or bearish trend.

While the Hindenburg Omen has been hailed as a reliable indicator by some analysts, others caution against placing too much emphasis on its signals. Critics argue that the indicator has a mixed track record and may sometimes produce false signals that fail to materialize into significant market movements. As with any technical indicator, the Hindenburg Omen should be used in conjunction with other tools and analysis to gain a comprehensive view of market conditions.

The flashing of an initial sell signal by the Hindenburg Omen has reignited debates about the current state of the market and the potential for a pullback in stock prices. Investors are advised to exercise caution and remain vigilant in monitoring market developments in the coming days and weeks. While the indicator alone is not a definitive predictor of market direction, it serves as a valuable signal to consider in the broader context of market analysis.

As market participants digest the implications of the Hindenburg Omen’s initial sell signal, it is essential to maintain a diversified portfolio, adhere to risk management strategies, and stay informed about market trends. By staying informed and prepared, investors can navigate volatile market conditions with greater confidence and make well-informed decisions to protect and grow their investments. The Hindenburg Omen, with its ominous name and complex criteria, serves as a reminder of the inherent uncertainty and risks present in the financial markets, urging investors to remain cautious and proactive in managing their portfolios.