In a recent turn of events, Tesla CEO Elon Musk faced a setback as he lost a bid to reinstate a $56 billion pay package. The proposal was brought forward by a Tesla shareholder and proxy advisory firm, Glass Lewis & Co., which argued that the pay package was excessive and not tied to any performance metrics.

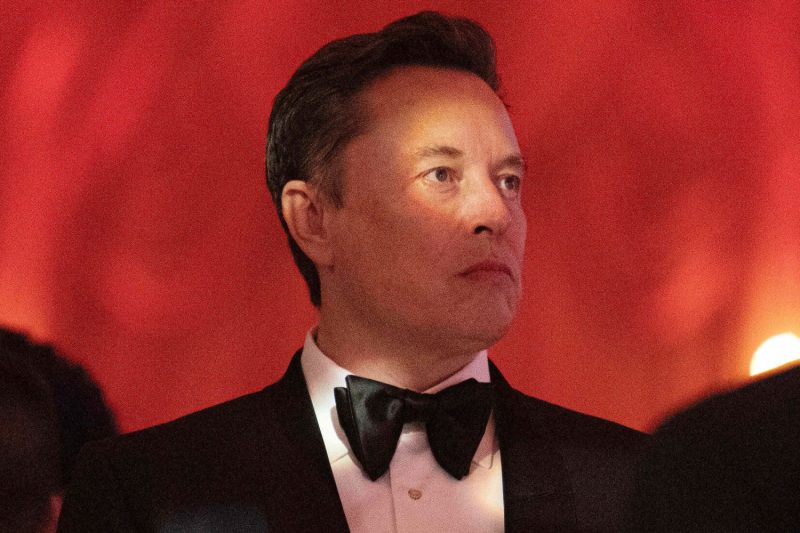

This development marks a significant moment for Musk, who has become synonymous with Tesla and its success over the years. The pay package in question was set to be one of the largest in corporate history and was designed to incentivize Musk to lead Tesla to new heights.

However, the rejection of the pay package raises important questions about executive compensation and corporate governance. Critics argue that such astronomical pay packages do not align with the interests of shareholders and can lead to a distortion of incentives for executives.

Despite the setback, Musk remains a key figure in the electric vehicle industry and the broader tech sector. His vision and leadership have been instrumental in driving Tesla’s growth and pushing the boundaries of innovation in sustainable transportation.

Looking ahead, it will be interesting to see how Musk and Tesla navigate this latest challenge. As the company continues to expand its product offerings and global reach, the focus on responsible corporate governance and aligning executive compensation with performance will be more crucial than ever. Balancing the interests of shareholders, executives, and employees will be paramount in ensuring Tesla’s long-term success.