The article presents a detailed analysis of the Nifty index and provides insights into potential market movements and key considerations for investors. It mainly focuses on the current market trends and suggests caution regarding leveraged exposures in the volatile market environment.

The analysis begins by highlighting the recent volatility in the Nifty index due to various domestic and global factors. The article emphasizes the importance of closely monitoring these factors to gauge the market direction accurately. Investors are advised to exercise caution when managing their leveraged exposures to mitigate risks associated with market fluctuations.

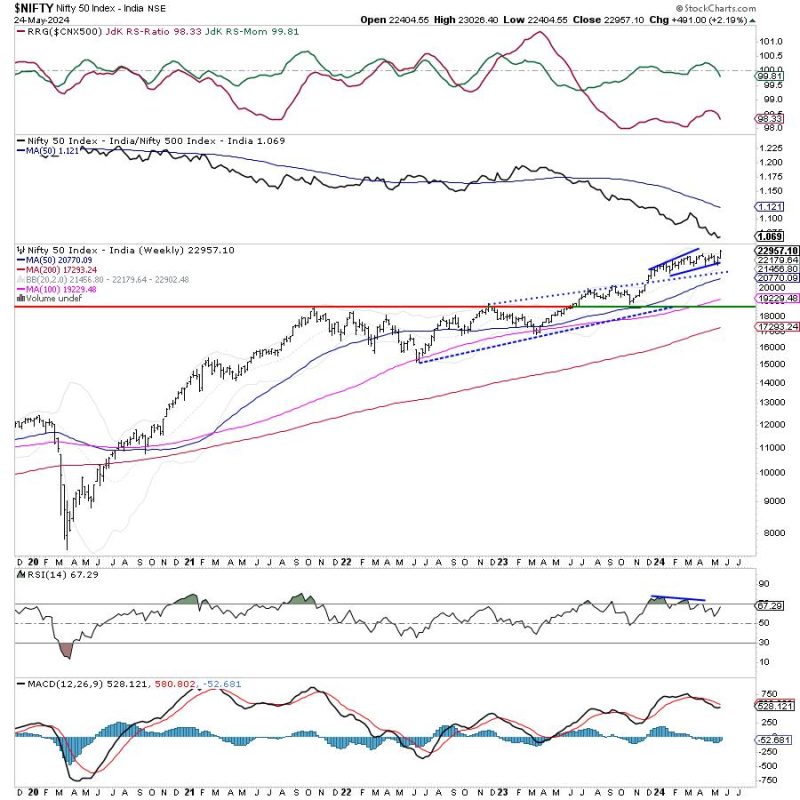

Moreover, the article points out the significance of analyzing technical indicators such as support and resistance levels, moving averages, and trend lines to understand the market sentiment better. By utilizing technical analysis tools effectively, investors can make informed decisions regarding their investments in the Nifty index.

In addition, the article discusses the impact of news events and economic data releases on the Nifty index’s movement. These external factors can significantly influence market behavior and create opportunities or risks for investors. Therefore, staying informed about upcoming events and their potential impact on the market is essential for making well-informed investment decisions.

Furthermore, the article suggests that investors should adopt a prudent approach in managing their leveraged positions during periods of high volatility. By reducing leveraged exposures and diversifying their portfolios, investors can safeguard their investments against sudden market swings and minimize potential losses.

Overall, the article provides a comprehensive overview of the Nifty index’s current market dynamics and offers valuable insights for investors looking to navigate through volatile market conditions successfully. By incorporating the suggested strategies and recommendations, investors can better position themselves to capitalize on market opportunities while effectively managing risks in the ever-changing financial landscape.