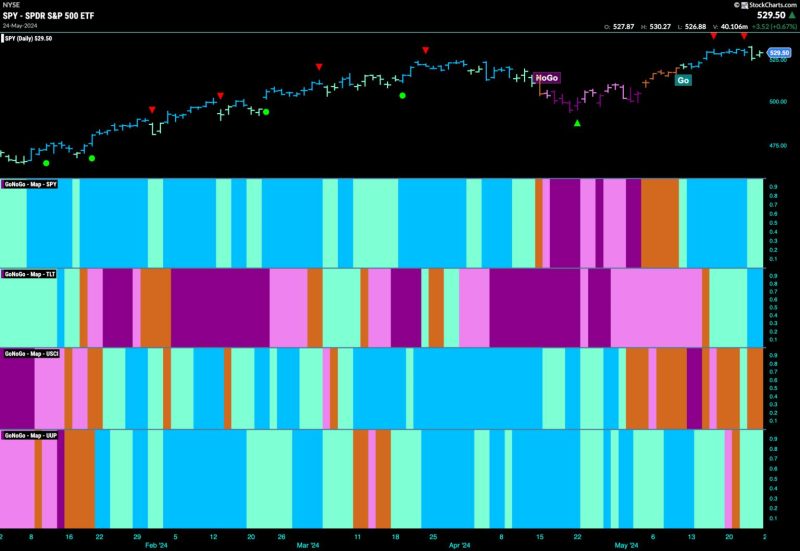

Equities Remain in Go Trend with Sparse Leadership from Tech and Utilities

The past few months have seen equities continuing to trend upward despite the ongoing challenges in the global economy. While the tech sector has traditionally been a key driver of stock market performance, the latest data indicates a shift in leadership towards other sectors. In particular, the utilities sector has emerged as a surprising frontrunner, providing much-needed stability amidst the volatility in other areas.

The rising prominence of utilities stocks can be attributed to several factors. Firstly, the sector is known for its defensive characteristics, making it an attractive option for investors seeking stability and reliable income streams. With the uncertain economic outlook and escalating geopolitical tensions, utilities companies are seen as a safe haven amid the turbulence.

Additionally, the current low-interest-rate environment has bolstered the appeal of utilities stocks, which are known for their steady dividend payments. As central banks around the world maintain accommodative monetary policies to support economic recovery, income-seeking investors are turning to utilities for attractive yields.

In contrast, the tech sector, which has been a standout performer in recent years, has shown signs of weakening. This shift can be partially attributed to concerns over regulatory scrutiny and valuation levels in the industry. As tech giants face increasing scrutiny over their market dominance and data privacy practices, investors are becoming more cautious about pouring capital into the sector.

Furthermore, the rotation from growth stocks to value stocks has also impacted the tech sector’s performance. As investors seek out undervalued opportunities in the market, traditional value sectors like utilities have gained favor over the high-flying tech stocks that have led the market rally in recent years.

Despite the changing dynamics in equity markets, it is important for investors to maintain a diversified portfolio that can weather market fluctuations. While utilities may offer stability and income, tech stocks still hold long-term growth potential due to their continued innovation and scalability. By striking a balance between defensive sectors and growth opportunities, investors can position themselves to navigate the uncertainties of the market with confidence.