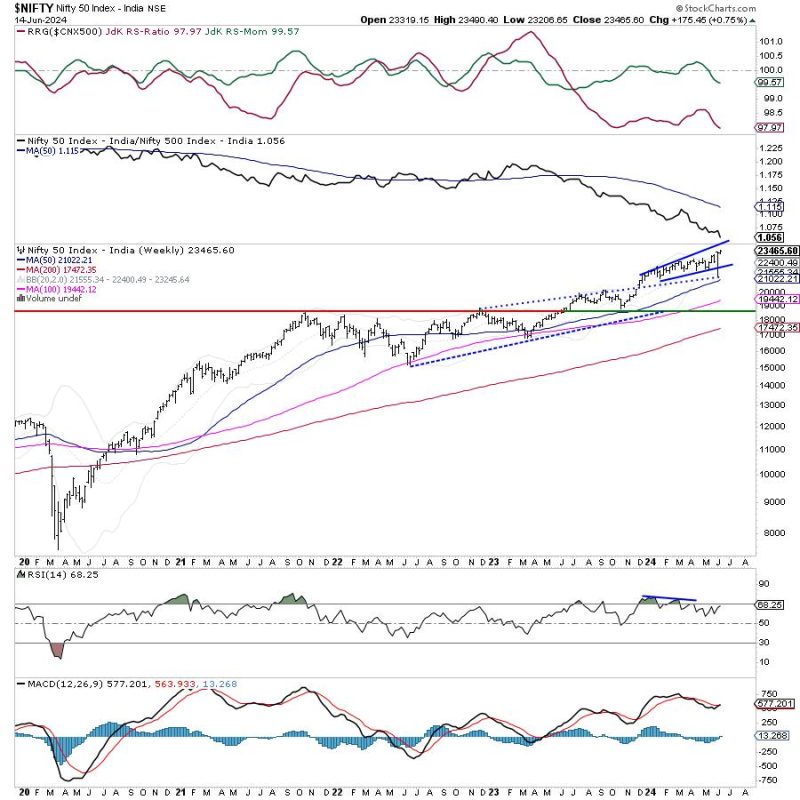

The article seems to provide valuable insights into the upcoming trends in the stock market, specifically focusing on the Nifty index. It emphasizes the importance of identifying stocks with strong relative strength for potential investment opportunities. This approach suggests a proactive stance towards market fluctuations, advising investors to stay cautious and look for robust stocks.

Staying attentive to the market’s tentative nature is essential in navigating through uncertain times. By prioritizing stocks with strong relative strength, investors can potentially outperform the market and mitigate risks associated with volatility. This strategy aligns with the goal of maximizing returns while minimizing the downside.

Analyzing the market sentiment and technical indicators can assist in identifying stocks that exhibit resilience and potential for growth. The emphasis on relative strength underscores the importance of comparing individual stock performance against broader market movements. This comparative analysis can reveal valuable insights into stock dynamics and provide a basis for sound investment decisions.

Moreover, the article’s suggestion to focus on sectors showing strength and positive trends reflects a strategic approach towards portfolio diversification. By allocating investments across sectors with promising outlooks, investors can spread risks and capitalize on sector-specific opportunities.

In conclusion, the article offers a pragmatic perspective on navigating the stock market amidst uncertainty. By emphasizing the importance of identifying stocks with strong relative strength and focusing on sectors showing positive trends, investors can position themselves for potential success in a tentative market environment. Keeping a watchful eye on market dynamics and staying proactive in stock selection are key tenets of a prudent investment strategy.