Sure, here is a structured and unique article based on the reference link you provided:

Technical Analysis Overview

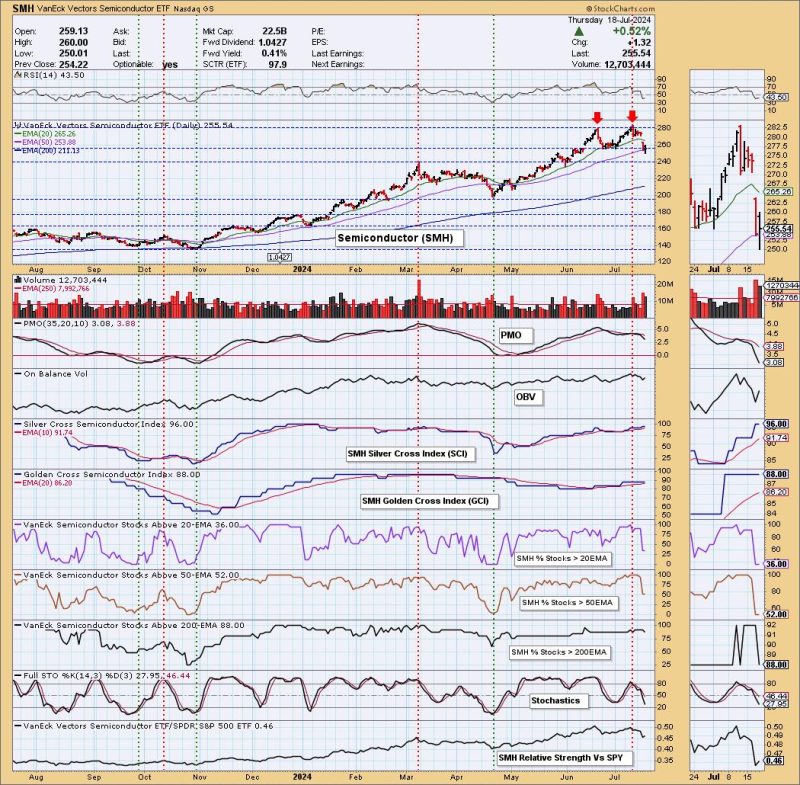

The semiconductor industry has been a key player in the global economy, driving innovation and technological advancements across various sectors. In recent times, the Semiconductor ETF (SMH) has shown signs of a double top pattern, indicating a potential trend reversal. Technical analysts use chart patterns like double tops to predict future price movements based on historical data.

Understanding a Double Top Pattern

A double top pattern is a bearish reversal pattern that forms after an extended uptrend. It consists of two peaks at a similar price level, with a trough in between. The pattern is complete when the price breaks below the trough, signaling a potential shift in the trend from bullish to bearish. Traders often look for confirmation through volume analysis and other technical indicators before making trading decisions based on this pattern.

Implications for Semiconductor Stocks

If the Semiconductor ETF (SMH) is indeed forming a double top pattern, it suggests a potential downtrend in semiconductor stocks. Investors and traders who follow technical analysis might interpret this pattern as a signal to consider reducing long positions or even entering short positions to benefit from the expected price decline. However, it is important to note that no pattern or indicator is foolproof, and risk management is crucial in trading decisions.

Alternative Scenarios and Risk Factors

While the double top pattern on the Semiconductor ETF (SMH) may indicate a bearish reversal, it is essential to consider alternative scenarios and risk factors. Market conditions, macroeconomic factors, geopolitical events, and company-specific news can impact semiconductor stocks independently of technical patterns. Traders should conduct thorough research and analysis beyond chart patterns to make informed decisions in a volatile market environment.

Conclusion

In conclusion, the emergence of a double top pattern on the Semiconductor ETF (SMH) suggests a potential trend reversal in semiconductor stocks. Traders and investors who use technical analysis may view this pattern as a signal to adjust their positions accordingly. However, it is crucial to consider risk factors and market dynamics beyond chart patterns to make well-informed trading decisions. As always, seeking advice from financial professionals and conducting thorough due diligence is recommended before making any investment decisions in the stock market.