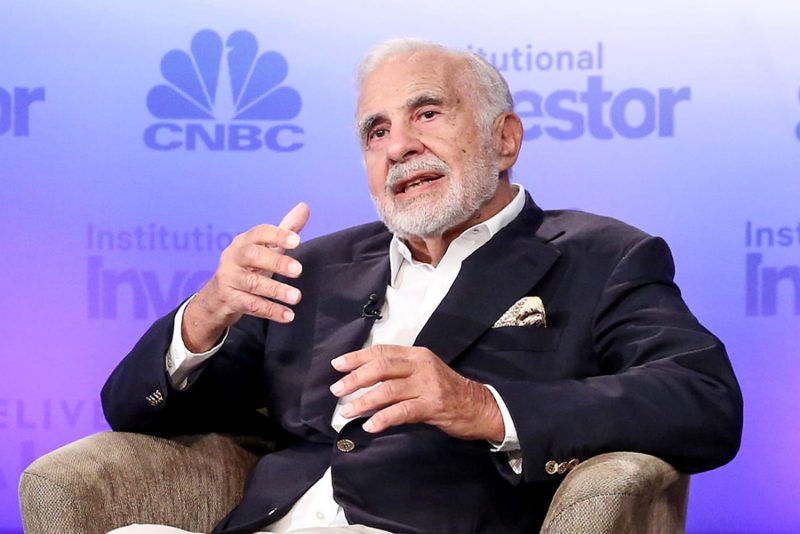

In a significant turn of events, the Securities and Exchange Commission (SEC) has brought charges against prominent billionaire investor Carl Icahn for allegedly concealing billions of dollars in stock pledges. This development has sent shockwaves through the financial industry and created a stir among investors and analysts alike. The allegations against Icahn paint a troubling picture of potential misconduct and deception at the highest levels of the financial world.

Carl Icahn, known for his aggressive investment strategies and strong influence in corporate boardrooms, has long been a polarizing figure on Wall Street. His reputation as a savvy investor who does not shy away from taking bold risks has earned him both admiration and criticism in equal measure. However, the recent allegations made by the SEC suggest that Icahn’s methods may have crossed ethical and legal boundaries.

The SEC’s charges against Icahn center around the accusation that he failed to disclose certain crucial information regarding his stock holdings and pledges. By allegedly hiding these multibillion-dollar stock positions, Icahn is said to have misled investors and the public about the extent of his financial interests and exposure. This lack of transparency raises questions about Icahn’s motives and the true nature of his investment activities.

The implications of these charges are far-reaching and could have a significant impact on Icahn’s reputation and business dealings. If found guilty of the SEC’s allegations, Icahn could face severe financial penalties, legal consequences, and potential damage to his standing in the investment community. The case against Icahn is a sobering reminder of the importance of transparency and accountability in the world of high finance.

Moreover, the SEC’s actions against Icahn serve as a warning to other investors and financial professionals about the consequences of failing to adhere to regulatory requirements. In an industry built on trust and integrity, any hint of impropriety or dishonesty can have serious repercussions. The charges against Icahn underscore the need for all market participants to conduct themselves with honesty and integrity at all times.

As the case against Carl Icahn unfolds, the financial world will be closely watching to see how it impacts his business empire and reputation. Whether Icahn will be able to weather this storm and emerge with his legacy intact remains to be seen. In the meantime, investors and observers will be paying close attention to how the saga of Carl Icahn and the SEC plays out in the weeks and months to come.