Sure, here is a unique article based on the reference link you provided:

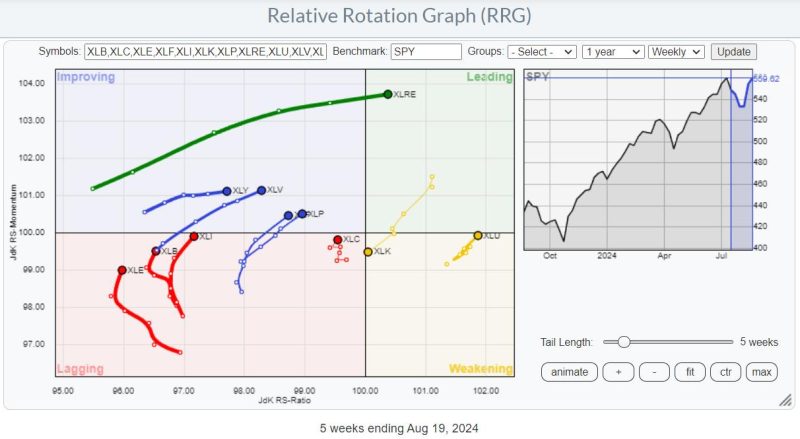

Risk Reversal Group (RRG) Velocity Jumping on XLF Tail

The Risk Reversal Group (RRG) has been making waves in the world of financial markets, particularly with its recent focus on the XLF sector. RRG Velocity, a key indicator used by the group, has been showing signs of vigorous activity, with a notable surge observed on the XLF tail.

RRG’s approach to analyzing market trends is rooted in the concept of momentum and relative strength. This methodology involves tracking the movement of various sectors and assets to identify potential opportunities for investment or trading.

The XLF sector, which includes companies in the financial services industry, has been a key area of interest for RRG due to its significance in the overall market ecosystem. The recent jump in RRG Velocity on the XLF tail indicates a heightened level of momentum and bullish sentiment in this sector.

One of the reasons behind this surge in activity could be attributed to the improving economic conditions and investor confidence in the financial services industry. As the economy continues to recover from the impact of the global pandemic, investors are looking towards sectors like XLF for potential growth opportunities.

Moreover, the Federal Reserve’s ongoing support through monetary policies and interest rate decisions also plays a crucial role in shaping the outlook for the XLF sector. The accommodative stance of the central bank has provided a favorable environment for financial institutions and has contributed to the positive momentum observed in the sector.

RRG’s focus on Velocity as a key indicator underscores the group’s emphasis on capturing timely market movements and identifying potential shifts in market sentiment. By leveraging this metric effectively, RRG aims to stay ahead of the curve and capitalize on emerging opportunities in the financial markets.

In conclusion, the recent surge in RRG Velocity on the XLF tail signifies a growing interest and momentum in the financial services sector. As investors navigate the uncertainties of the market landscape, tools like RRG Velocity serve as valuable resources for tracking market dynamics and making informed investment decisions. With continued monitoring and analysis, RRG aims to navigate the evolving market conditions and unlock potential opportunities for its clients.