The article provided analyzes the current trend in the Nifty index and suggests that there may be signs of a disruption in the uptrend. This analysis is essential for investors and traders in the stock market to make informed decisions about their investments.

The Nifty index, which is a benchmark index for the Indian stock market, has been on an uptrend for a considerable period. However, recent indicators suggest that this trend may be at risk of disruption. It is crucial for investors to tread cautiously in such situations to protect their investments.

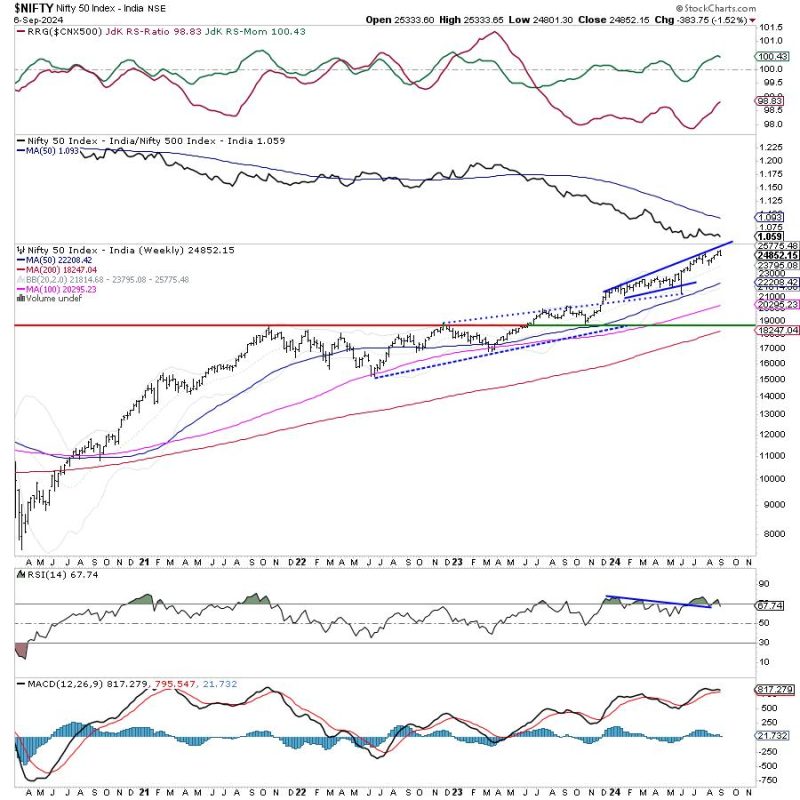

One of the key indicators mentioned in the article is the Relative Strength Index (RSI). The RSI is a momentum oscillator that measures the speed and change of price movements. When the RSI reaches certain levels, it may signal that the market is overbought or oversold, indicating a potential reversal in the trend.

In addition to the RSI, other technical indicators such as moving averages and trend lines can also provide valuable insights into the market trend. By analyzing these indicators, investors can better understand the current market conditions and make informed decisions about their investments.

It is important for investors to exercise caution and not be guided solely by emotions or short-term fluctuations in the market. By conducting thorough research and analysis, investors can better navigate volatile market conditions and protect their portfolios from potential risks.

In conclusion, the recent indicators suggesting a disruption in the uptrend of the Nifty index serve as a warning for investors to tread cautiously. By paying attention to technical indicators and conducting thorough analysis, investors can make informed decisions to protect their investments in the stock market.