Sector Rotation Dilemma: Balancing Risk and Return

Investors are often faced with the challenge of balancing risk and return when it comes to sector rotation strategies. Sector rotation involves shifting investments from one sector to another based on the performance outlook of different sectors within the market. While this strategy can help optimize returns, it also comes with inherent risks that investors must carefully consider.

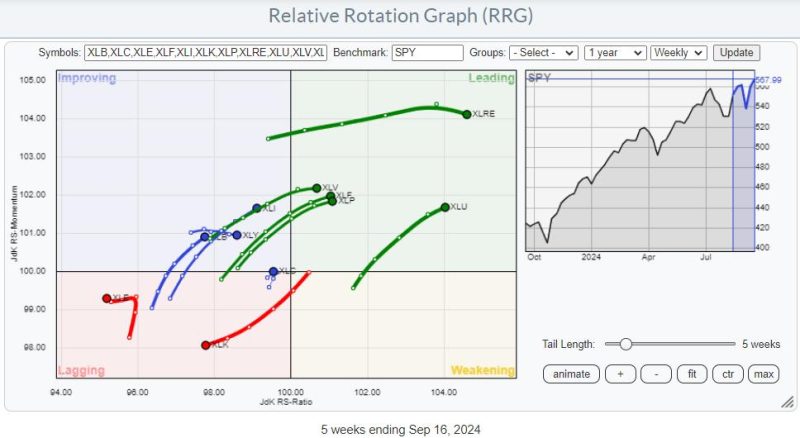

One of the primary benefits of sector rotation is the potential to outperform the broader market. By strategically allocating investments to sectors that are expected to outperform in a given market environment, investors can capture higher returns than those achieved through a static investment approach. For example, during periods of economic expansion, sectors such as technology and consumer discretionary tend to perform well, while defensive sectors like utilities and consumer staples may underperform.

However, the success of sector rotation strategies is not guaranteed, and timing plays a crucial role in their effectiveness. Predicting sector performance accurately is challenging, as market conditions can change rapidly due to a variety of factors such as economic indicators, geopolitical events, and company-specific news. This uncertainty can lead to suboptimal investment decisions and, in some cases, underperformance relative to a buy-and-hold strategy.

Moreover, sector rotation strategies may also expose investors to increased volatility and concentration risk. Concentrating investments in a few sectors amplifies the impact of sector-specific events on the overall portfolio performance. For instance, if a sector experiences a sudden decline due to regulatory changes or adverse market conditions, investors with heavy exposure to that sector may face significant losses.

Another factor to consider is transaction costs associated with frequent portfolio rebalancing in sector rotation strategies. Buying and selling assets to reallocate investments in different sectors can erode potential returns through brokerage fees, bid-ask spreads, and taxes. Therefore, investors need to carefully assess whether the expected gains from sector rotation justify the additional costs incurred.

To mitigate the risks associated with sector rotation, investors can adopt a diversified approach that combines elements of both sector rotation and asset allocation. By maintaining a balanced portfolio that includes investments across various sectors and asset classes, investors can reduce concentration risk and protect against underperformance in specific sectors.

Ultimately, successful sector rotation requires a deep understanding of market dynamics, a disciplined approach to portfolio management, and a willingness to adapt investment strategies based on changing conditions. While sector rotation can be a valuable tool for enhancing returns, investors must remain vigilant of the risks involved and carefully weigh the potential benefits against the drawbacks to make informed investment decisions.