In the realm of financial markets, the debate regarding the impact of interest rate cuts on stock performance continues to be a topic of great interest and speculation. Investors, analysts, and economists closely monitor central bank decisions on rates, often trying to predict how these policy changes will influence the stock market.

Historically, interest rate cuts are often viewed as a bullish signal for stocks. The rationale behind this perspective is quite straightforward – lower interest rates translate into cheaper borrowing costs for companies, leading to increased investment, expansion, and ultimately higher corporate profits. Additionally, lower interest rates may encourage consumers to spend more, stimulating economic growth and ultimately benefiting corporate earnings.

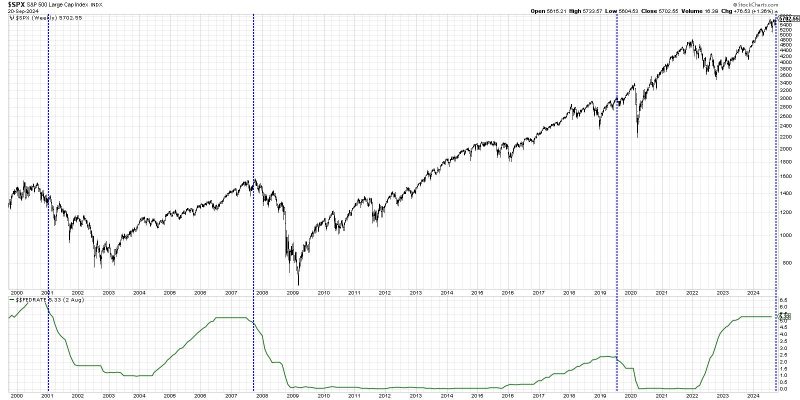

However, the relationship between interest rate cuts and stock performance is more complex and nuanced than the simplistic bullish narrative suggests. While rate cuts may provide a temporary boost to stocks, the long-term benefits are not always guaranteed. In some cases, excessive rate cuts could be interpreted as a signal of underlying economic weakness, leading to market uncertainty and volatility.

Furthermore, the effectiveness of rate cuts in driving stock performance can vary depending on the broader economic conditions. During economic downturns or recessions, interest rate cuts may not be sufficient to offset the negative impact of broader macroeconomic factors such as declining consumer confidence, weakening demand, or geopolitical instability.

Moreover, the impact of rate cuts on specific sectors or industries within the stock market can diverge significantly. For example, industries that are highly sensitive to interest rates, such as banking or real estate, may experience adverse effects following rate cuts due to compressed margins or reduced demand for mortgages.

When evaluating the impact of rate cuts on stock performance, it is essential to consider the broader macroeconomic context, as well as the specific characteristics of individual companies and industries. While rate cuts can certainly play a role in driving stock market returns, they are just one of many factors that investors should consider when making investment decisions.

In conclusion, the relationship between interest rate cuts and stock performance is multifaceted and cannot be reduced to a simple bullish or bearish dichotomy. While rate cuts may provide a short-term boost to stocks, their long-term impact is contingent on a variety of factors, including broader economic conditions, sector-specific dynamics, and market sentiment. Investors should exercise caution and conduct thorough analysis when interpreting the implications of interest rate cuts on stock market performance.