As investors navigate the financial markets in search of profitable opportunities, it is essential to approach market moves with a comprehensive perspective. By observing key indicators and technical analysis tools, traders can better understand the current market trends and make informed decisions. One such indicator that investors can keep an eye on is the Nifty index, which provides insights into the performance of the Indian stock market.

The Nifty index, also known as the Nifty 50, is comprised of the top 50 companies listed on the National Stock Exchange of India (NSE). It serves as a benchmark index, reflecting the overall performance of the Indian equities market. Traders often use the Nifty index to gauge market sentiment, identify potential trading opportunities, and manage risk effectively.

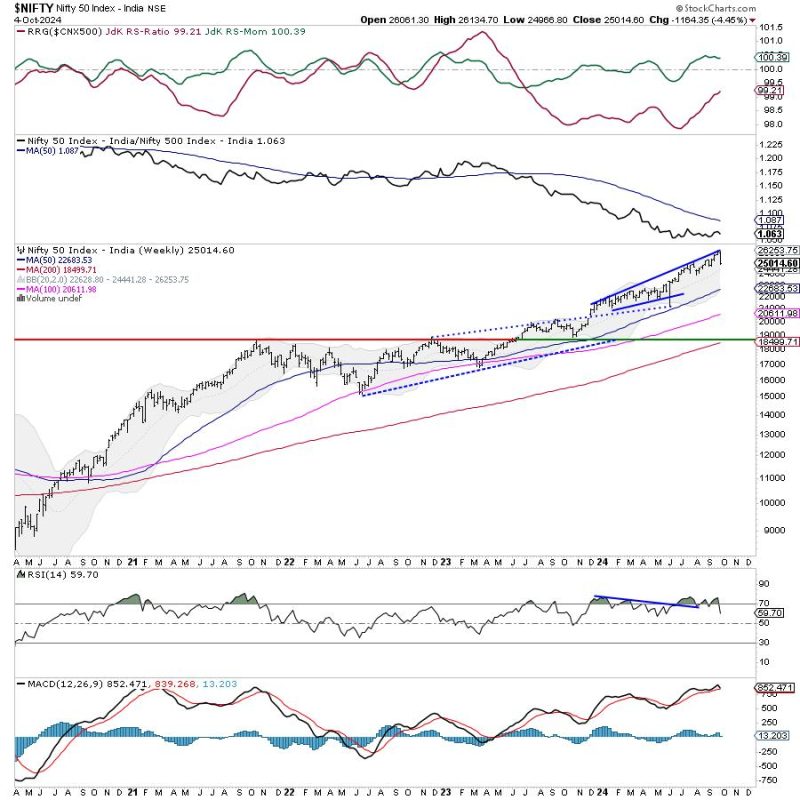

Technical analysis plays a crucial role in interpreting market moves and forecasting future price trends. By analyzing historical price data and chart patterns, traders can identify key support and resistance levels, trend reversals, and potential entry and exit points. Popular technical indicators such as moving averages, relative strength index (RSI), and Fibonacci retracement levels can provide valuable insights into market dynamics.

In addition to technical analysis, fundamental analysis is another important tool that investors can utilize to evaluate the intrinsic value of stocks and assess overall market conditions. Factors such as economic indicators, corporate earnings, industry trends, and geopolitical events can impact market movements and influence investor sentiment.

It is essential for traders to adopt a disciplined and systematic approach to trading, based on a well-defined trading plan and risk management strategy. By setting clear entry and exit criteria, establishing profit targets and stop-loss levels, and adhering to risk-reward ratios, traders can optimize their trading performance and minimize potential losses.

In conclusion, navigating market moves requires a comprehensive perspective that integrates technical and fundamental analysis, risk management, and disciplined trading practices. By staying informed about key market indicators such as the Nifty index and utilizing appropriate analytical tools, traders can make informed decisions and maximize their trading success in the dynamic world of financial markets.