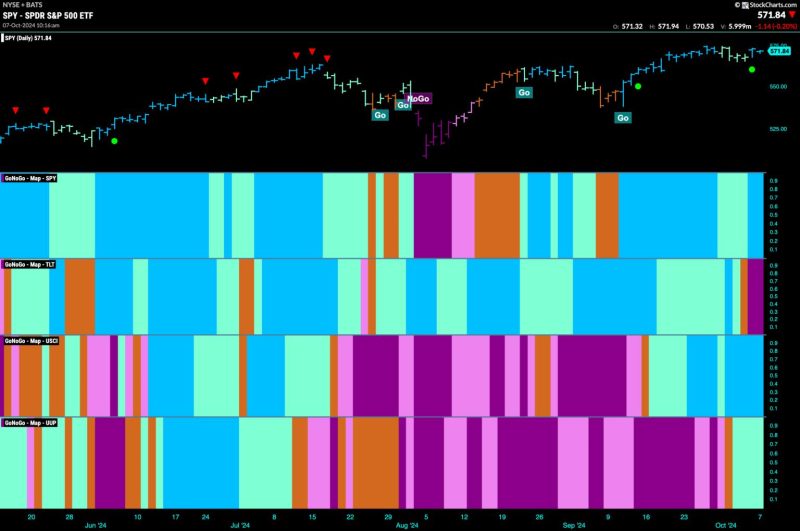

Equities Remain in Go Trend and Lean into Energy

In the ever-changing landscape of investments, equities continue to be a prominent choice for both individual and institutional investors. The current trends in the market suggest that equities are still in a go trend, with various sectors showing promising signs of growth. Among these sectors, the energy sector stands out as one that investors are leaning into for potential returns.

The energy sector has long been a significant player in global markets, with traditional sources like oil and gas dominating the industry. However, recent shifts towards renewable energy sources and sustainability have brought new opportunities for investors to capitalize on. Companies specializing in solar, wind, and other clean energy solutions are gaining traction as the world moves towards a greener future.

Investors are drawn to the energy sector not only for its growth potential but also for its resilience. Energy is a fundamental need in our society, and companies that provide essential services in this sector are likely to have stable revenue streams regardless of market fluctuations. As the world becomes more conscious of climate change and environmental impact, investing in sustainable energy solutions is not only profitable but also aligns with ethical considerations.

While the energy sector presents exciting opportunities, investors should also be mindful of potential risks. The sector is highly regulated, with policies and environmental standards playing a significant role in shaping the industry. Changes in government regulations or shifts in consumer preferences can impact the performance of energy companies, making it essential for investors to stay informed and adaptable.

Furthermore, the energy sector is sensitive to geopolitical developments and global economic conditions. Factors like supply and demand dynamics, geopolitical tensions, and technological advancements can all influence the performance of energy stocks. Diversification and risk management strategies are crucial for investors looking to navigate the complexities of the energy sector and maximize their returns.

In conclusion, equities remain in a go trend, with the energy sector emerging as a promising area for investors to lean into. Companies specializing in renewable energy solutions offer growth potential and align with sustainability trends, making them attractive investment opportunities. However, investors should also be aware of the risks associated with the energy sector and adopt a prudent approach to manage their investments effectively. By staying informed, diversifying their portfolios, and adapting to changing market conditions, investors can position themselves for long-term success in the dynamic world of equities.