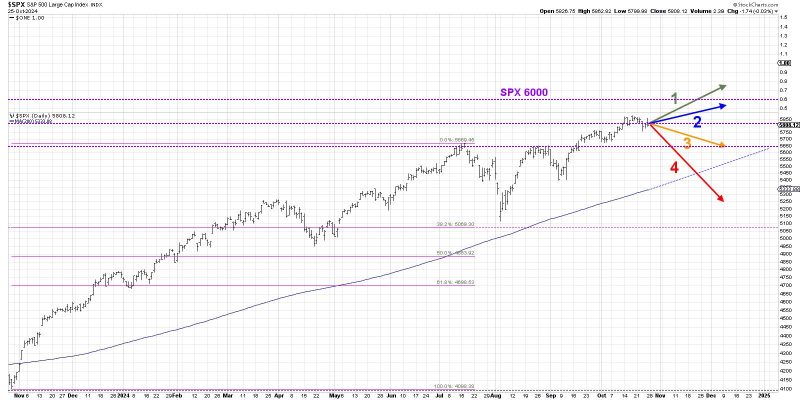

The cited article provides an insightful analysis of the factors hindering the S&P 500 from breaking the 6000 mark. While the article raises valid points regarding the current economic landscape and market conditions, there are several additional aspects to consider in assessing the likelihood of the S&P 500 reaching this significant milestone in the near future.

Corporate Earnings

One crucial factor that influences the movement of the S&P 500 is corporate earnings. Companies’ financial performance directly impacts their stock prices, and robust earnings reports often drive market indices higher. In the wake of the COVID-19 pandemic, many companies have reported strong earnings due to cost-cutting measures and increased productivity in a digital work environment. As the global economy continues to recover, corporate earnings are expected to improve, potentially providing the necessary momentum for the S&P 500 to break the 6000 barrier.

Interest Rates and Inflation

Another key consideration in forecasting the S&P 500’s movement is the Federal Reserve’s monetary policy, especially interest rates and inflation. The Fed’s decision to keep interest rates low has supported equity markets by making stocks more attractive than fixed-income securities. Additionally, concerns about inflation have eased in recent months, alleviating investor fears of rising prices eroding real returns on investments. As long as the Fed maintains its accommodative stance and inflation remains in check, the S&P 500 could have a favorable environment for a sustained upward trend towards 6000.

Technological Innovation and Sector Performance

The rapid pace of technological innovation has propelled certain sectors of the economy to new heights, contributing significantly to the overall performance of the S&P 500. Tech giants like Apple, Amazon, and Microsoft have emerged as market leaders, driving substantial gains in the index. Furthermore, sectors such as healthcare, renewable energy, and electric vehicles are poised for growth in the coming years, potentially lifting the S&P 500 to unprecedented levels. An investor’s focus on these high-growth sectors could play a pivotal role in driving the index towards the 6000 mark.

Global Economic Conditions

The interconnected nature of the global economy means that international events and macroeconomic trends can have a profound impact on the S&P 500. Geopolitical tensions, trade agreements, and economic indicators from major economies such as China and the Eurozone can influence investor sentiment and market volatility. A stable and growing global economy provides a conducive environment for the S&P 500 to break through psychological barriers like 6000. Monitoring global economic conditions and their implications for US markets is essential in assessing the index’s growth prospects.

In conclusion, while there are valid reasons supporting the argument that the S&P 500 may not imminently break the 6000 threshold, a comprehensive analysis of corporate earnings, interest rates, sector performance, and global economic conditions suggests that the index has the potential to reach new highs in the foreseeable future. Investors should carefully monitor these factors and adapt their strategies accordingly to capitalize on the evolving market dynamics and opportunities presented by a potential surge past 6000.