The upcoming week for the Nifty is likely to see a continuation of sluggish movement as multiple resistances are situated in a critical zone. Investors and traders need to closely monitor key levels and market cues to navigate through potential volatility and make informed decisions.

Technical Analysis Highlights:

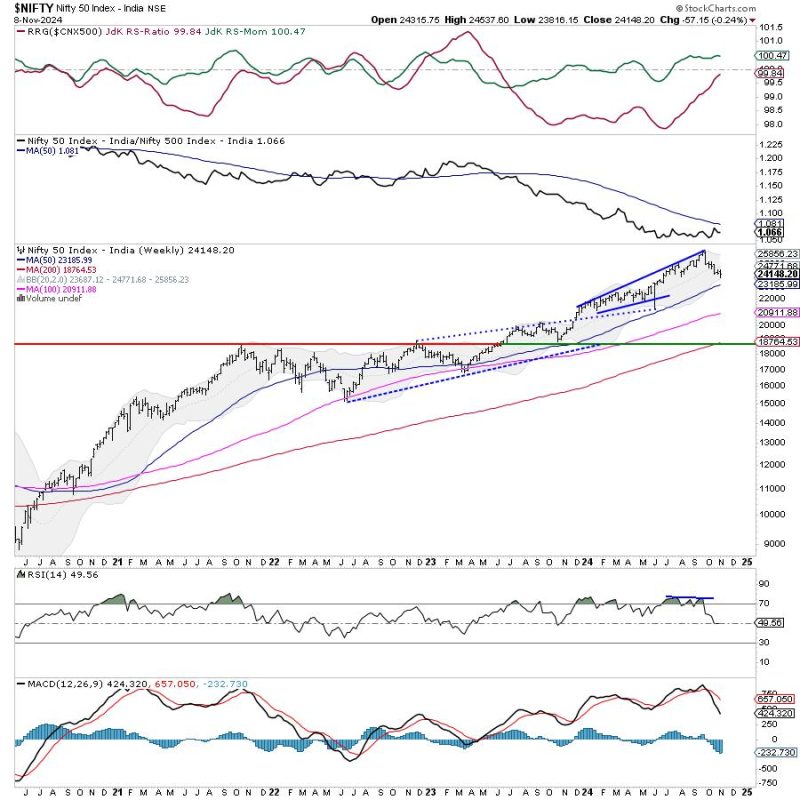

1. **Resistance Zone:** The Nifty is currently facing strong resistance levels within a concentrated zone. Traders should closely watch these levels for a potential breakout or reversal in trend.

2. **Support Levels:** On the flip side, it is crucial to identify key support levels that can act as a buffer in case of a downside movement. These levels provide critical guidance for risk management and trade execution.

3. **Chart Patterns:** Technical analysts are closely monitoring various chart patterns such as triangles, channels, and moving averages to gauge the market sentiment and potential future movements. These patterns can offer valuable insights into possible price actions.

Market Sentiment and News:

1. **Global Factors:** The global market environment, including geopolitical tensions, economic indicators, and central bank policies, can significantly impact the domestic market sentiment. Investors should stay informed about international developments to better understand market dynamics.

2. **Economic Data Releases:** Key economic data releases such as GDP numbers, inflation rates, and industrial production figures can sway market sentiment and influence trading decisions. Traders should keep an eye on these releases to anticipate market movements.

3. **Corporate Earnings:** Earnings reports from major companies can serve as catalysts for market movements. Positive or negative earnings surprises can impact stock prices and sectoral indices. Investors should be prepared for potential market reactions to these corporate announcements.

Trading Strategies and Risk Management:

1. **Diversification:** Maintaining a diversified portfolio can help mitigate risks and enhance returns. Investors should consider allocating their investments across different sectors and asset classes to reduce concentration risk.

2. **Stop-loss Orders:** Traders should implement stop-loss orders to limit potential losses and protect their capital. Setting stop-loss levels based on technical analysis and risk tolerance can help in disciplined trading practices.

3. **Risk-Reward Ratio:** Evaluating the risk-reward ratio for each trade is essential for effective risk management. Traders should assess the potential upside and downside of a trade before execution to ensure favorable risk-reward dynamics.

In conclusion, the week ahead for the Nifty presents challenges and opportunities for market participants. By integrating technical analysis, monitoring market sentiment, and implementing sound risk management strategies, investors and traders can navigate through the uncertainties and make well-informed decisions in the dynamic stock market environment.