In the world of forex trading, the value of the USD is always a hot topic for discussion among traders and analysts. Recently, there has been speculation regarding a potential rally in the USD. The US dollar, often seen as a safe haven currency, has the potential to strengthen in times of uncertainty or economic instability. In this article, we will take a closer look at whether the USD is indeed setting up for a perfect rally.

One of the key factors that could influence the USD’s performance is the state of the US economy. Economic indicators such as GDP growth, unemployment rates, and inflation are closely monitored by traders to gauge the health of the economy. A strong economy typically leads to a stronger currency as investors have more confidence in the country’s economic prospects. Therefore, if the US economy continues to show signs of resilience and growth, it could support a rally in the USD.

Another important factor to consider is the Federal Reserve’s monetary policy. The Federal Reserve plays a crucial role in shaping the value of the USD through its interest rate decisions and monetary stimulus measures. If the Federal Reserve signals a more hawkish stance by raising interest rates or reducing stimulus, it could boost the USD as investors seek higher returns on their investments in US assets.

Geopolitical events and global economic conditions also play a significant role in determining the value of the USD. Factors such as trade tensions, political uncertainty, and global market volatility can impact investor sentiment and lead to fluctuations in currency values. In times of uncertainty, the USD tends to benefit from its safe-haven status, attracting investors seeking stability and security.

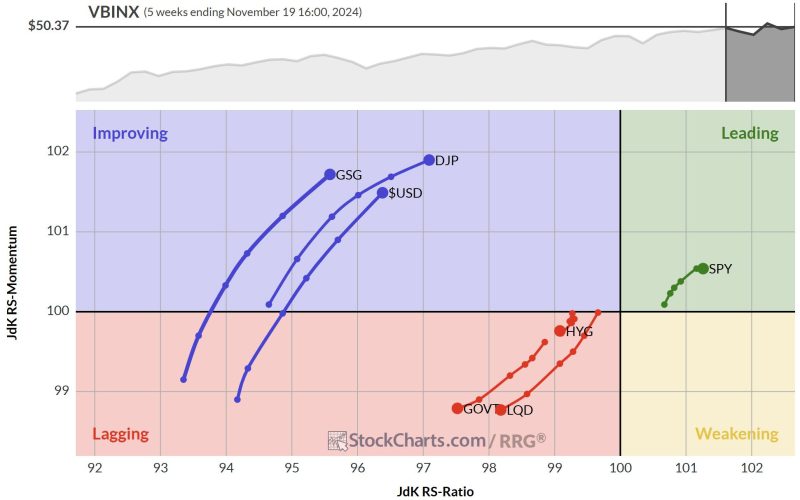

Technical analysis is another tool that traders use to assess the potential for a currency rally. By analyzing charts, trends, and patterns, traders can identify key levels of support and resistance that could signal a potential upward movement in the USD. Technical indicators such as moving averages, Fibonacci retracements, and relative strength index (RSI) can provide valuable insights into market sentiment and potential price movements.

In conclusion, while there are several factors that could contribute to a rally in the USD, it is important for traders to carefully monitor economic data, central bank policies, geopolitical developments, and technical indicators to make informed trading decisions. The USD’s status as a safe-haven currency and its role in the global economy make it a key player in the forex market, and any potential rally could have far-reaching implications for traders and investors worldwide. By staying informed and adapting to changing market conditions, traders can position themselves to take advantage of potential opportunities presented by a USD rally.